Social Security Options

In General:

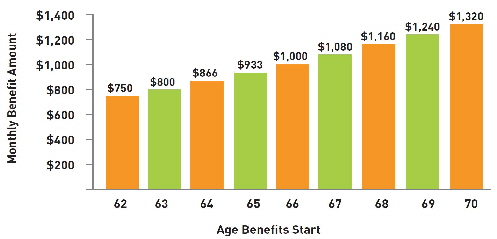

You are allowed to start claiming your Social Security payments as early as age 62. However this will result in a discounted payment amount of approximately 8% a year that you take your payment before your Full Retirement Age (FRA).

Obviously this can result in a large loss of cash over the years if you take benefits at 62 or any year before your FRA.

Example: If you were to activate your Social Security benefits at:

Age 62 your monthly benefit may be $750

Age 66 your monthly benefit may be $1,000 (FRA)

Age 70 your monthly benefit may be $1,320

As you can see waiting until at least FRA is a good way to collect more benefits over your retirement years. An example is if you activate your payments at 66 instead of 62, (a $250 month difference) the additional income in payments by age 76 would total $30,000.00 more by waiting until FRA to activate benefit payments.

Ask yourself, would you possibly need the additional money when your 62, or would you need it more at 66?

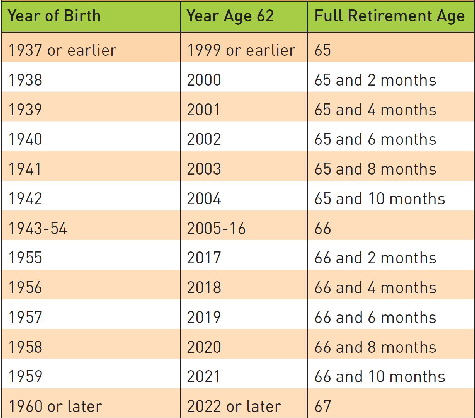

Table 2.

Full Retirement Age by Year of Birth.

You can increase your benefits by working longer and waiting to activate your Social Security.

However, if you work and activate your Social Security early before your FRA you can and will be penalized if you make too much income. You will be penalized $2 for every $1 dollar you make above $15,720.00.

Once past your FRA you can make as much income as you want and not be penalized. But you will pay income tax on any Social Security income as well as your employment income.

Married?

There are several strategies for married couples, but here is some general information to start.

If anything happens to one spouse the surviving spouse can choose the larger of the two Social Security benefit amounts.

The longer you work will increase your monthly benefit amount. This is especially helpful if something happens to you. Your spouse would receive the higher amount.

One spouse can claim 50% of the other spouses Social Security benefit after age 66 or FRA. This would be optimal if the spouse’s 50% is larger than the one they currently receive in benefits. This is called the “File and Suspend” strategy and there are additional considerations to this strategy.

Your Social Security benefit amount grows by 8% a year if you wait to take it. This can be especially beneficial if you are working past 66 and waiting to activate your Social Security benefits.

Single?

If you are single your best bet is to wait until at least your FRA so that you maximize your monthly benefit. The longer you work the higher you benefit amount will be.

If you are single and divorced and you were married longer than 10 years, you may file for 50% of your ex-spouses Social Security income. The ex-spouse will continue to receive their full Social Security benefit amount.

If you are single and widowed/widower you can claim the larger of the 2 Social Security benefits of you or your deceased spouse. Again, if you are younger than your spouse and you are the surviving spouse you may want to wait until your FRA to begin your benefits so that you receive 100% of the benefits, either yours or the deceased spouse.

Disability?

You can file for Medicare and Social Security Disability benefits any time after you reach age 18. This can involve everything from Medical assistance to Social Security Disability Income or SSI.

To apply online you must;

-There is a 12 month waiting period to qualify and you must provide documentation or proof of disability.

-You are not currently receiving benefits on your own Social Security record;

-You have not been denied disability benefits in the last 60 days.

-If you are denied, you can file an appeal.

A complete explanation for a the disability application process can be found at

www.ssa.gov/disabilityssi/apply

Table 1.

Monthly Social Security Benefits Are Higher If You Wait

This website is not affiliated with Social Security. 123EasySocialSecurity.com is privately owned and operated by American Retirement Advisors. 123EasySocialSecurity.com is a non-government resource. We make understanding Social Security123 Easy. If you're looking for the official Social Security website, please visit www.ssa.gov